The Real Estate Capital Gain is the positive difference between the purchase price and the resale price of a property. The tax payable on the Real Estate capital gain is the one that you must pay when the sale price is higher than the purchase price when acquiring the property.

Capital gain tax is a type of tax levied on capital gains when you sell a property for a price that is higher than the purchase price.

Total sale price = selling price + purchaser expenses – selling costs

Purchasing price = buying price + acquisition costs + expenses for works + expenses for roadways and distribution networks

Tax rate on capital gain:

Net capital gain is taxed at 19% for the income tax, and 15.5% for social security contributions.

Since January 1st 2013, if the amount of the taxable capital gain for the income tax exceeds €50 000, the seller must pay a surtax from 2% to 6% (except building lands).

Exemption:

Real estate capital gain is exempt from tax if it is the sale of the principal residence. There are also other cases when the sale is exempt of capital gain tax.

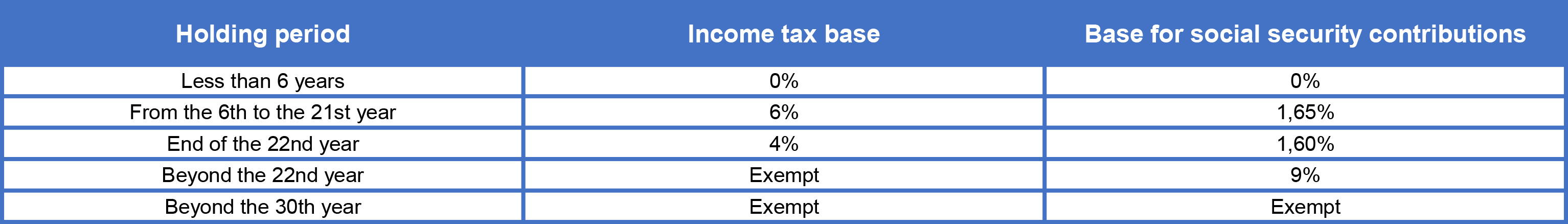

Rate of allowance applicable each year of ownership

Plus-Value is totally exempt from tax, if the sale is a principal residence. However, the Plus-Value will be taxed at 36.2% when it comes to the sale of a second home or a rental property held for less than 30 years.

Evaluation of the taxable capital gain

Base for calculating the capital gain

The difference between the selling price – less the transfer fees and the amount of V.A.T (Value Added Tax) paid – and the purchase price (plus registration fees actually paid at the time of purchase or a flat rate of 7.5% of the price purchase price) corresponds to the capital gain. It may also be the value declared when the property was received by donation or inheritance, that is to say, plus actual costs and free transfer duties if these were borne by the donee or the heir.

Works expenditure

Works expenses including construction, reconstruction, and / or expansion or improvement may increase the basic purchase price when they have been borne by the seller and done by a tax-declared company.

The evaluation of the Real Estate capital gains as well of taxable land income are defined according to the work undertaken. While maintenance and repair expenses, as well as major repairs, are not included in the expenses for the calculation of the Real Estate gain.

You will be advised by the notary to keep all the proof of payment for the expenses work of your secondary residence because its selling price will be increased according to its actual expenses related to the housing improvement.

15% flat rate increase will be applicable without invoices or proof, in case you have held the property for at least five years.

The income tax and the social security contributions are evaluated according to the rate of the deduction for the taxable period of holding.

Exemption from the Real Estate capital gains Tax

- After 22 years for income tax,

- After 30 years for social security contributions.

Years of ownership are deducted from the anniversary of the acquisition (purchase, donation, or death) of the property.

There will be an exceptional decrease, depending on conditions of the capital gains resulting from the sale of Real Estate or building land. An exceptional tax deduction is applied, conditionally and temporarily, to evaluate the net taxable capital gain on income tax and social security contributions.

Provisions of the II of article 28 of the law n ° 2017-1775 of December 28th, 2017 of rectifying finance for 2017.

For the reconstruction of one or more collective residential buildings, capital gains resulting from the sale of building land or built-up buildings (intended for demolition).

This only concerns Real Estate property being located in geographic areas with a large imbalance between housing supply and demand.

The Plus-Values are determined after application of an exceptional reduction of 70% up to 85% in case of double condition:

- The assignment must be preceded by a unilateral or synallagmatic signed sales promise with a definite date of 1st January 2018 and no later than 31st December 2020;

- The transfer must be made no later than 31st December of the second year following the year in which the unilateral or synallagmatic promise of sale has acquired a definite date.

My Favorites

My Favorites