If there is no will or donation, the law determines the heirs of an inheritance. Each heir has to pay the inheritance tax within 6 months following the death.

If the deceased was a resident

You are submitting to the inheritance tax on all goods, whether you are in France or abroad (unless otherwise provided by international conventions).

If the deceased was a non-resident

The rule for taxation depends on the place of your tax residence:

• if you are domiciled in France the day of your death, and you have been domiciled at least 6 years for the past 10 years, you are submit to pay inheritance rights on all received goods, whether they are in France or abroad.

• if you are domiciled abroad the day of the death, only the goods in France are taxable.

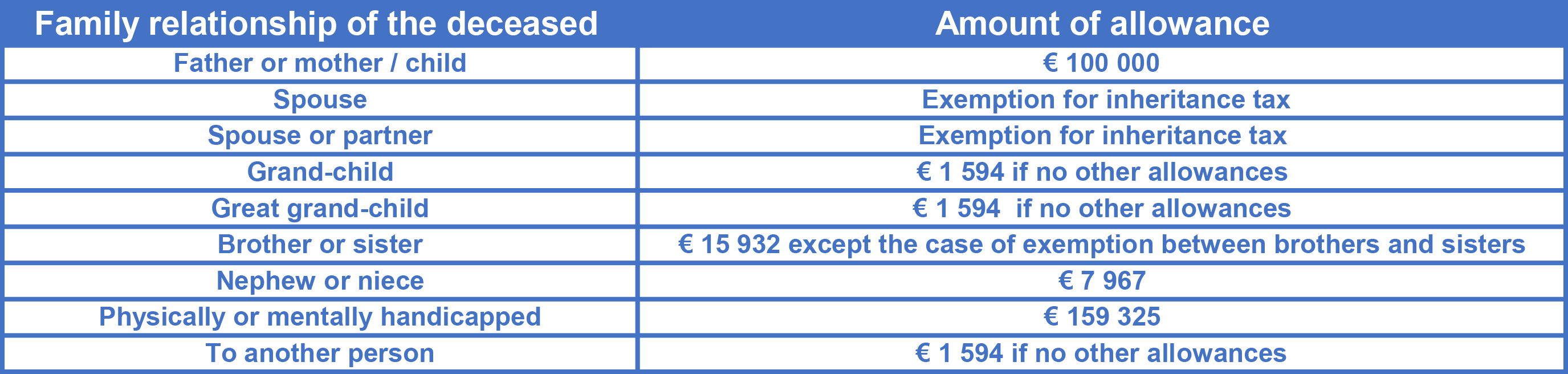

Allowances are foreseen on inheritance tax and depend on the family relationship to the deceased.

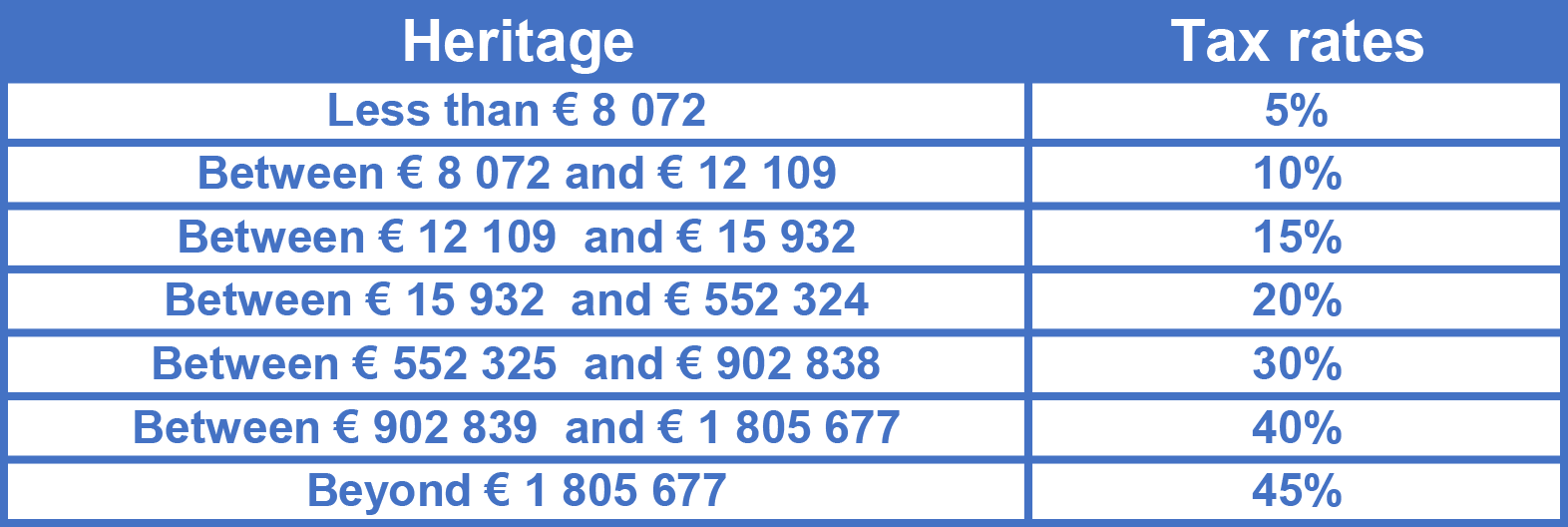

Once the allowance applied on the inheritance / donation shares, you have to pay inheritance / donation taxes, calculated according to a progressive tax scale and according to the family relationship.

Inheritance and donation taxes for direct descendant, on January 1st, 2017

My Favorites

My Favorites