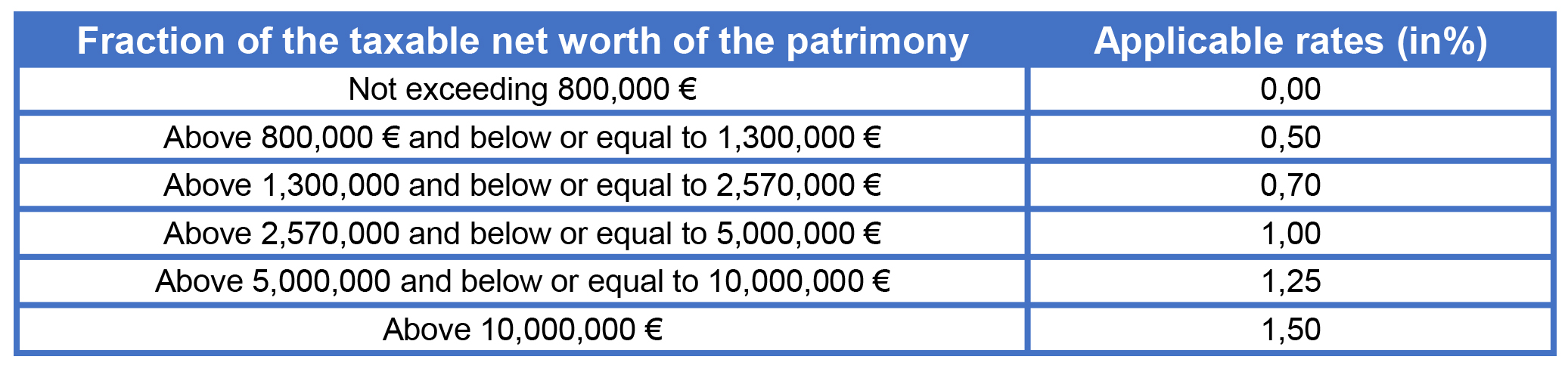

For the second year, the IFI – Tax on Real Estate Wealth – replaces the ISF (Solidarity Tax on Wealth) by limiting itself to real estate not affiliated with a professional activity. Its tax rate varies from 0.5% to 1.5%.

Today, the wealth tax only covers real estate. Since January 1st, 2018, you have to declare the amount of the value of your real estate under the Tax on Real Estate (IFI).

This tax concerns only households whose real estate assets exceed € 1,300,000 (not allocated to professional activity) on January 1 of the current year.

The value that you would sell these properties must be the value that you hold on January 1st of the reporting year.

At this time, you will have to hold the value to which you would sell these properties.

Evaluation of your property

A comparison can be made in the same geographic area with similar properties to evaluate this value.

The fiscal public administration has many global elements, generally based on references of changes that often do not consider the specificities of each Real Estate.

You can rely on the average real estate values identified by some specialized website such as “Patrim” published by the Tax Administration. (impots.gouv.fr). It is supposed to record sales these recent years.

Also, the website of the Superior Council of Notaries (Baromètre.immobilier.notaires.fr) provides free statistics of prices for the province.

In addition, a professional real estate expert as an agency like New Place in Port Grimaud, will be able to determine the value of your property. Do not hesitate to contact us for more information.

The value of each property is unique with its characteristics, the average value fluctuates:

– Decrease its price, if for example your property requires very large renovation work or other large works or if it has defects.

– Or revisit it upwards, if the situation is very much in demand (view, secure neighborhood, … etc), or if the property is rare and it has exceptional qualities. (big ground, garden, balcony, terrace, space, utilities, appendices, … etc).

You will have to inquire about a possible promise of sale that engages the owner with a potential buyer.

Indeed, if the property is under promise of sale, a potential purchaser therefore enjoys a privileged right for a fixed period in the act.

So, it will be useful to consider this option even if the sale is not final.

Revaluation of the previous value

This is a method of raising the value of your property each year. But this method can only be used for recent or very recent acquisition.

Beyond 3 years, it is not recommended, unless you have, a very fine analysis of the evolution of median prices per neighborhoods …

Free value is an approach to be favored by operating an haircut more or less high related to the occupation of the property in question.

The value according to the yield, it is however usually accepted by the tax administration: an average between the value of yield and the one of the surface area.

The rate of return is expressed as a percentage. It makes it possible to calculate the profitability of an investment.

In case of the Tax Administration intends to make adjustments, it will have to refer to sales realized on similar properties located in the same district.

New Place offers this type of real estate assessment based on the property’s previous value. Established and specialized in the Real Estate of Port Grimaud, our expertise guarantees you an accurate and real evaluation of your property. (Period of construction, number of floors, “vis-à-vis” or screw, and other important details.)

IFI tranches unchanged in 2019

Taxpayers subject to the IFI, as under the ISF, benefit from the same allowances (- 30% on the value of the principal residence, for example).

The income tax and the amount of the IFI cannot exceed 75% of the income.

Furthermore, IFI taxpayers can only reduce their tax by donating to associations and foundations up to 75% of the amount of the payment.

Today, the reduction related to the subscription to the capital of PME (Small and Medium Enterprises) which allowed a tax reduction has been removed.

My Favorites

My Favorites